Rehabbing Houses On A Spending Plan: 9 Step Overview

Are you all set to tackle these relatively small hassles to profit? The remainder of the cash from your lending institution enters into your escrow account. The loan provider (or its agent) launches escrowed funds to the contractor as work is completed. On a $250,000 financing, that's $4,375 upfront and also $177 per month. Fannie Mae's HomeStyle ® mortgage enables you to rehab a home as well as purchase with simply 5 percent down.

For how long Does It Require To Rehab A Home?

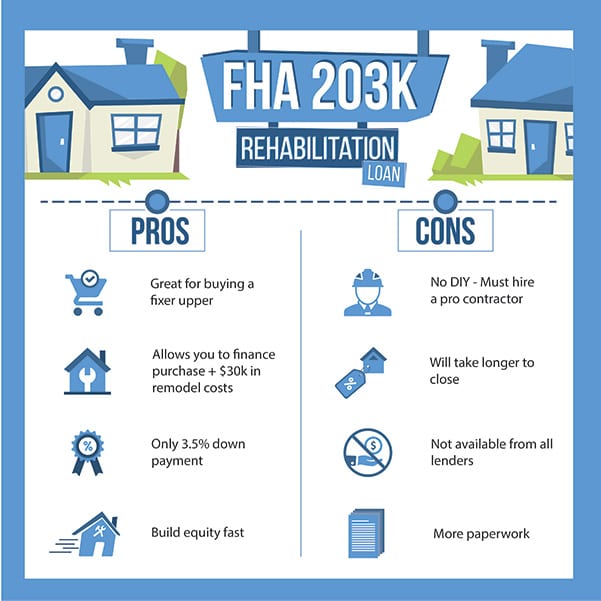

The 203k lets you take care of and purchase up a home in one purchase, enabling the lender to approve the loan regardless of its first problem. Shape Home mortgage has actually been supplying various improvement loans, including 203( k) loans, to house buyers for more than two decades. While some people may jump at the chance to refurbish as well as personalize a residence, there are others who would certainly choose to buy a property that doesn't require any type of job. Customers that aren't thinking about making any major changes to their following house would certainly benefit from considering other funding choices.

Can I do the repairs myself with a 203k loan?

Would it be possible to finance the windows/roof, but pay for the bathroom myself?" Yes! You can finance repairs needed to pass an FHA inspection or desired repairs done by a professional. If there are DIY home improvements you want to tackle, simply don't roll them into the bids for the work with the FHA 203k.

I usually bring your house up as if I were mosting likely to market it. Being an absentee owner, I intend to do all that needs doing while I exist. That will better allow me to recognize what needs to be done if something breaks later on, because I have carnal understanding of what went on before.

What qualifies for a rehab loan?

You must have 1) a 580 credit score (some lenders require 620-640); 2) a 3.5% down payment, based on purchase price plus repair costs; 3) adequate income to repay the loan; 4) U.S. citizenship or lawful permanent residency. In addition, you must be purchasing a home you plan to live in. How does a 203k loan work?

We do not take part in direct advertising by phone or e-mail towards consumers. Call our assistance if you are questionable of any kind of illegal tasks or if you have any type of concerns. Mortgageloan.com is a news and information solution offering editorial web content as well as directory details in the area of home loans as well as lendings. Mortgageloan.com is exempt for the precision of information or in charge of the accuracy of the rates, APR or lending details posted by loan providers, brokers or advertisers.

- See to it your specialist has actually supplied a solid proposal and has not underbid the job at all.

- I always anticipate needing to pay several of my customers closing prices.

- If you are not a Real estate professional and also you plan on working with a Real estate agent then you possibly will need to budget 6% for the Realtor costs plus another 2-3% for closing expenses.

- You can select to attempt to sell the residence on your own and also conserve the Real estate agent payment.

Is a rehab loan a good idea?

It could help you make money in the long run. Ideally, you want to be able to make money off of the property when you go to sell it down the road. However, fixer uppers pose an even greater return on investment (ROI) because you could significantly increase their value by making critical upgrades and repairs.

When rehabbing a residential or commercial property will certainly virtually always entail the interior of the residence, the core costs. Depending on the fixings that need to be made, this extent of job will usually require the greatest budget. For the most part, most of job (and expenses) of rehabbing a house will certainly originate from projects like repair services to the A/C, plumbing as well as electrical systems. Nonetheless, there are a few things capitalists can do to stay clear of overspending. Prior to determining to take on a home rehabilitation, you should be certain that it will see a worthwhile roi.

On top of that, the residence must be purchased as the buyer's owner-occupied home, just like with any kind of FHA lending. One of the most essential aspect of the Streamline 203k is the amount of cash you can finance for repairs, which maxes out at $35,000.

What is the best order to remodel a house?

Demolition, rough work (framing changes, electrical and plumbing rough-in), drywall, paint the drywall. And then on to the finishes: flooring, cabinets, trim https://t.co/hROT5oef1F?amp=1 molding, appliances, electrical fixtures.

. The objective of the clean-up is to prep the residential property for improvements, which will certainly enable the rehabbing https://goo.gl/maps/jU4yu8rRfSxK16kW9 process to run smoother. Additionally, this phase can be completed for next to nothing in cost, as most of work can be finished via your very own sweat equity.

What to do first when fixing up a house?

Small Projects Paint the house, inside and out, to give it a fresh feeling. Replace the flooring, using wood if you can, to add value. Re-landscape the front and back lawns for curb appeal. Install new bathroom and kitchen hardware if a total renovation is out of your budget.

Having a negative credit rating is normally a deal-breaker when it involves relating to fundings. Nonetheless, some lenders agree to accept the risk as well as deal finances to those with much less than desirable credit scores. Carrington Mortgage is recognized for accepting borrowers with credit scores in the low 500s. Understand you will certainly probably obtain a worse price than at other loan providers, as well as you will certainly more than likely owe a larger deposit, but it may be your only path to approval. Numerous of the rehabilitation funding options on this checklist require you to come right into a branch place to use.

The Federal Real estate Administration's (FHA) 203k https://earth.google.com/web/data=Mj8KPQo7CiExMDNYMGJLVHgyN21LU1NwUGxLU3RjM2ktZ09HOVRoZlISFgoUMEU0NEQ3MUU4NDE0MjZDRTY0Qjg lending enables purchasers to finance the homeandup to $35,000 in repairs with one car loan. Make sure that your offer has language showing that you need a 203k finance in order to finish the acquisition. Note that your maximum car loan quantity computation is various for purchases. Take a look at HUD' sMaximum Home loan Worksheetfor much more info. Get several mortgage quotes so you can be positive that you're getting a good deal.